We collaborate with forward-thinking companies at any stage of their ESG journey. We are all in this together, from idea to continual implementation.

Our commitment towards

Sustainable Finance

Individuals and organizations all across the world rely on smart green investing to secure their financial futures. Bringing together the power of unique, trustworthy analysis, artificial intelligence, and cutting-edge technology.

Smart Green Investing is committed to combating climate change and promoting sustainability within organizations by offering ESG (Environmental, Social, and Governance) analysis reports. To subscribe to our ESG reports, please visit our website.

Our Partners

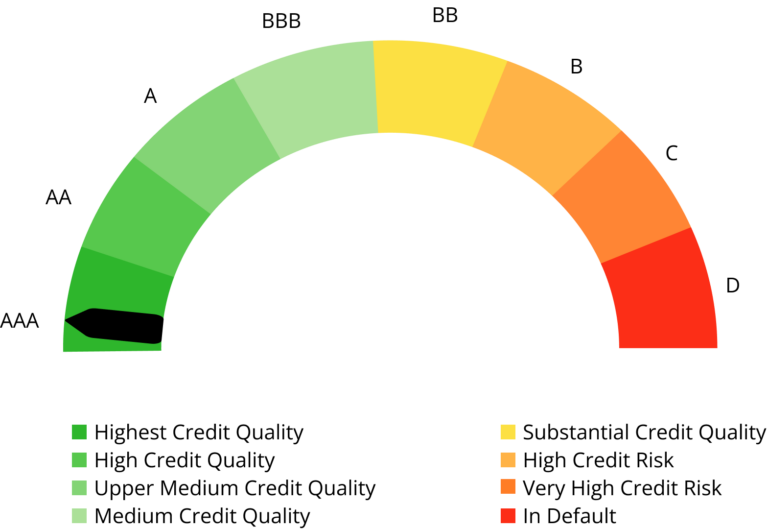

Credit Scoring Using AI

Our credit teams work seamlessly across many ERPs and business divisions, analyzing credit risk in a single, global currency. Based on our AI-powered credit score algorithm, we also estimate the company’s risk of bankruptcy so that they may take necessary steps to avoid falling bankrupt.

Investor Community

We connect borrowers To lenders and our investors Invest in ESG Focused companies.

We are just not a community of investors but a community of entrepreneurs and data analysts as well. We have board of investors who believe in long-term goals and vision, and ESG practices are a crucial part of that plan. Efforts to encourage sustainable practices will make it simpler to keep shareholders satisfied with the board’s leadership. Larger quantities of money are shifting to ESG investment, which will have a stronger impact on policy.

By concentrating on ESG, the administration may be able to reduce capital expenses while increasing the firm’s worth. Because superior ESG performance draws investors, such enterprises may also have access to bigger pools of capital.

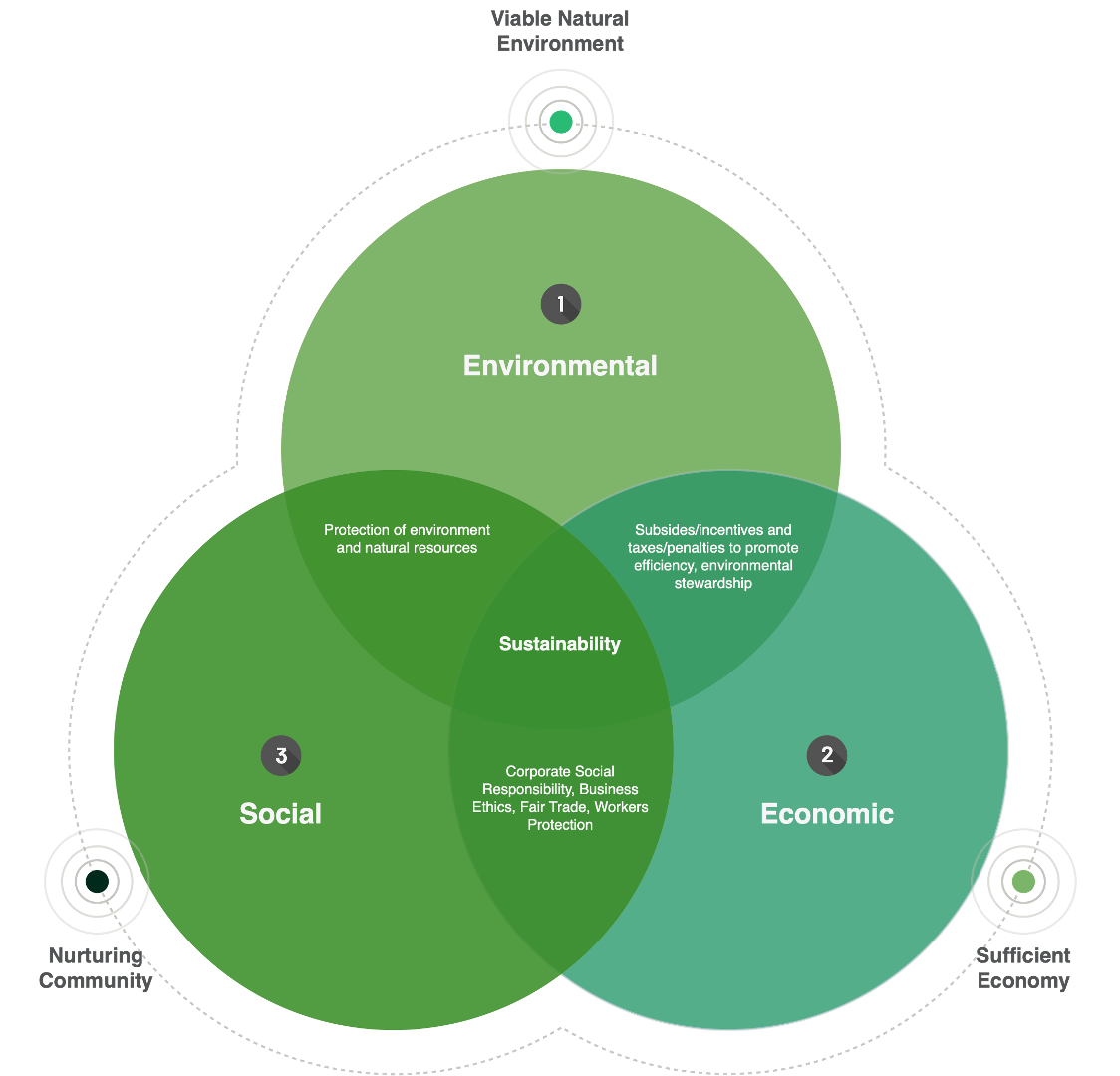

Principles of Environmental, Social, and Governance in Credit Ratings

Our ESG credit indicators provide additional openness and disclosure at the entity level, as well as our evaluation of the influence of environmental, social, and governance factors on our credit rating analysis. They are not standalone sustainability assessments or analyses of an entity’s ESG performance.

Our Expertise

Smart Green Invest takes responsibility for keeping their programmes on track, communicating with stakeholders, assessing the status and development of each project.

Get Insighs on Latest Trends

Smart Green Invest is in charge of keeping their programmes on track, engaging with stakeholders, and analysing the state and progress of each project.

Enough talking, let's go to work on your project

SmartGreenInvest powers the financial future of individuals and organizations around the world. Combining the power of distinctive, trustworthy data, artificial intelligence, and cutting-edge analytics

Address: 128 City Road, London, EC1V 2NX, UK.

Phone: +44 20 3693 39 41 , +352 661 118 418

© 2024 SmartGreenInvest. All rights reserved | Privacy Policy